Introduction

Early patent disputes greatly affected the commercial application and promotion of LFP cathode material. However, overseas patents had not been authorised by China. Therefore, the commercialisation of LFP cathode material in China has been relatively smooth, and development of the new energy vehicles industry has promoted commercialisation.

During 2015 to 2016, the production output of LFP batteries was higher than that of ternary material batteries. However, from 2017 to 2019, as Chinese government subsidies favoured high-energy density materials, the production of ternary material batteries closed in on LFP batteries in 2017 and overtook LFP batteries in 2018.

From 2018 to 2020 ternary had been the mainstream cathode material for batteries, but in 2020 LFP began to increase rapidly, accounting for 39% in 2020 and up to 52% in 2021. Breakthroughs, such as cell to pack and blade technologies launched by end 2019 to early 2020 which saw an increased upper limit of the volume energy density of LFP and with subsidies in decline making the cash cost prominent for producers, this led to a gradual recovery of LFP demand and output and the overtaking by LFP of ternary material.

Principal Processing Methods

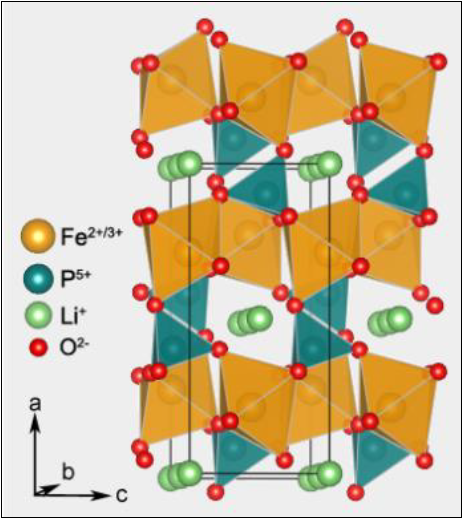

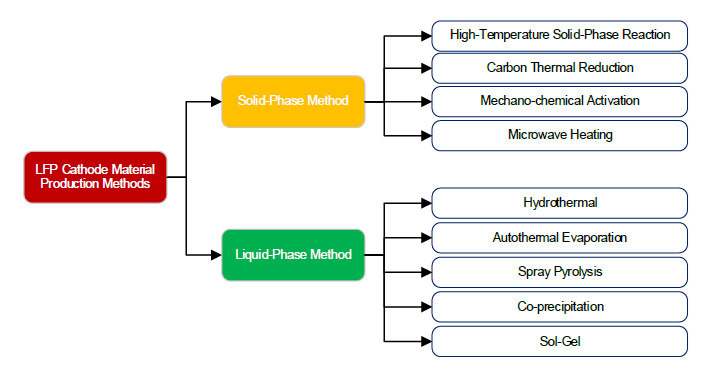

LiFePO4 cathode material can be prepared by both solid phase synthesis and liquid phase synthesis methods. Solid state techniques are carried out at high temperatures without the addition of any solvent. Liquid based methods are based on reactions that take place in the presence of appropriate solvent systems.

Today, in China’s LFP cathode material industry, the solid-phase synthesis method-carbothermal reduction method is the production method currently most widely used method, accounting for more than 80%~90% of production due to its relatively simple process and high technology maturity.

Commercialisation

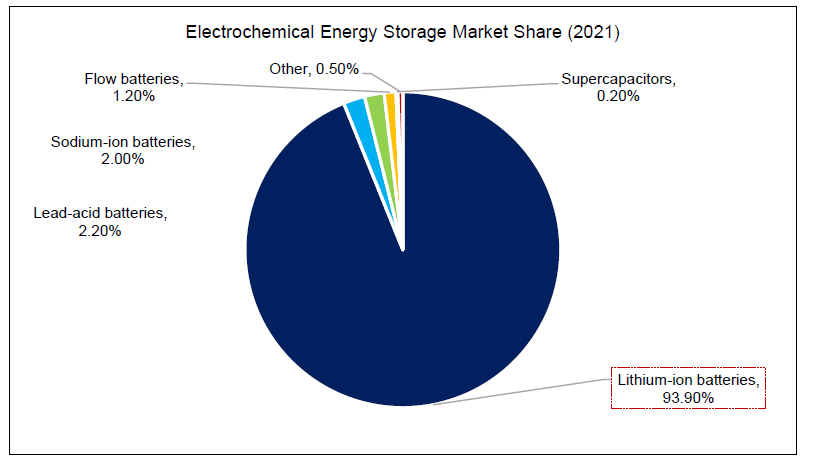

Mainstream energy storage methods include conventional pumped, compressed air, flywheel, superconducting battery, supercapacitors, lithium-ion, lead-acid, flow batteries, and sodium-sulfur batteries.

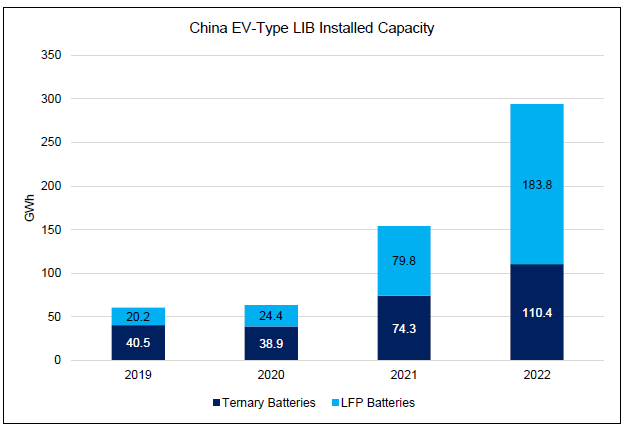

The rapid increase in demand for LFP batteries has pushed up demand for LFP cathode material. LFP batteries using in EVs is increasing, in 2022, cumulative installed capacity of EV-Type LIB was 294.6GWh, up 91% yoy. For instance, ternary batteries installed was 110.4GWh, accounting for 37.5%, and LFP batteries installed was 183.8GWh, accounting for 62.4%, respectively.

In the field of electrochemical energy storage, lithium-ion batteries have great potential for future industry development. Compared with other energy storage batteries, lithium-ion batteries have advantages in terms of energy density, response speed, and flexible configuration. In the future, with the further development of lithium-ion battery technology, the application potential of lithium-ion batteries is huge.

Energy storage has requirements on thermal management, as LFP batteries have high safety, this will continue to drive demand. Firstly, compared with energy density and safety in field of EVs, the energy storage field has stricter safety performance requirements. Secondly, ternary batteries might be prohibited to be used in the medium and large electrochemical energy storage power stations. Moreover, these policies might help the LFP cathode material market expand in market share. The increased demand for LFP cathode material means that market participants, including suppliers, can have high expectations for the future.

Competitive Landscape

In 2021, production and consumption of LFP cathode in China was 451,600t and 452,000t, up 190.1% and 190.8% yoy, respectively. From January to August 2022, the output of LFP cathode material was 575,300t, up 185% yoy, accounting for 61%. As such the production output LFP cathode of far exceeds that of ternary cathode and continues to maintain its growth. Moreover, the market concentration is relatively high, with a competitive situation between the top major companies.

Contact us to purchase the full report today

Click to view the Table of Contents

What is driving the growth of the global LFP cathode material industry?

LFP cathode material is gaining traction due to its low cost and thermal stability. Unlike ternary cathode material, it does not contain expensive metals, such as cobalt and nickel, making them an attractive option for manufacturers looking to reduce costs. At the same time, the thermal stability increases its safety in comparison to other types of cathodes. However, ternary cathode material is also popular due to its high energy density

How is the market segmented and which countries are leading its growth?

LFP cathode material is mostly produced in China

Is LFP cathode material becoming more popular than ternary cathode material and why?

The evolving research and technological advancement in cathode material and efficient electrolytes, which could enhance their overall performance in terms of stability, charge density, and durability, offer great opportunities for the LFP cathode material market over the next five years.

What are the key trends shaping the future the industry?

Firstly, the LFP cathode market is expected to demonstrate a surplus until 2035, but demand will eventually catch up. Secondly, the Chinese government is very supportive of energy transition and EV supply chain localisation, especially the LFP cathode which is more environmentally friendly than its rivals. Thirdly, the growing product application in the automotive and electronic sectors has been driving market growth.

Further reading

Our research reports include an introduction, industry chain, product specifications, processing methods, raw material requirements, cash cost analysis, pricing metrics, future industry development trends, and the competitive landscape. Reach out by email and contact us today to learn more.

You might be interested in our other battery mineral research reports

For Further Information