Introduction

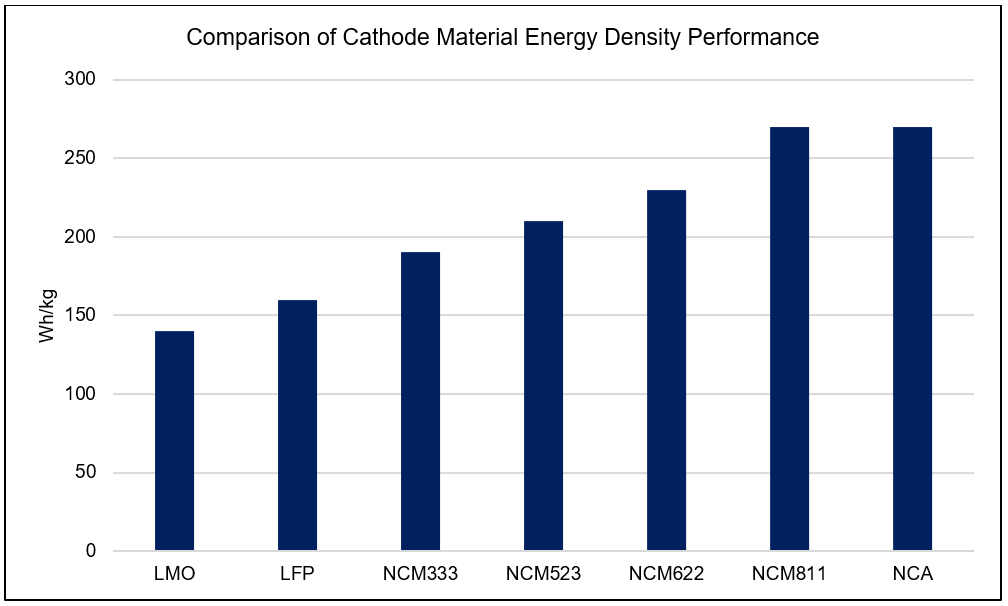

Ternary cathode combines nickel, cobalt, and manganese to improve the overall performance of the cathode material. Ternary cathode has the characteristics of good electrochemical performance, good cycle performance, and high energy density. Moreover, it is widely used in the fields of high-end electric vehicles but has the disadvantage of high production costs.

Furthermore, based on the demand from lithium-ion battery manufacturers wanting higher and higher energy density, and consumers wanting longer mileage per charge, it is expected that ternary cathode material technology industry roadmap will develop towards using high-nickel cathode material in the future.

Principal Processing Methods

Ternary cathode material has good physical and chemical properties, today the mainstream production method is the chemical co-precipitation hydrometallurgy method.

The principal production methods used to produce ternary precursor materials include sol-gel precipitation method, spray drying method, and co-precipitation method. Of which, the mainstream ternary precursor production technology route used today is the co-precipitation method, which belongs to hydrometallurgy process. Moreover, the downstream is passed through high-temperature solid phase preparation of ternary cathode materials by pyrometallurgy method.

Under the co-precipitation method, ammonia water is used as a complexing agent to complex nickel, cobalt, and manganese metal ions, and the complex ions of metal ammonium formed helps the metal ions to be released slowly. In addition, NaOH is added as a precipitant, and the slowly released metal ions react to form co-precipitates. The co-precipitation method is conducive to form of hydroxide precursors with good sphericity, uniform particle size, and high tap density.

Commercialisation

With the development of related technologies and the integration of vehicle platform functions, new energy vehicles will continue to develop towards higher energy density and longer mileage in the future with high-nickel ternary material as the development trend of primary lithium-ion batteries. In 2024, China’s production of ternary cathode material will still be dominated by NCM523, accounting for 46%. Moreover, this will be followed by NCM811 series high-nickel products, accounting for 36%, and NCM622 series products accounting for 16%, respectively.

Competitive Landscape

There are not many companies in China that can deliver high-nickel ternary materials in batches, and the battery companies with higher shipments are mainly Ningbo Ronbay New Energy Technology Co., Ltd, Tianjin Bamo Technology Co., Ltd, BTR New Material Group Co., Ltd, and Hunan Bangpu Recycling Technology Co., Ltd.

Of which Ronbay New Energy high nickel production accounts for about 70% and leading the high-nickel ternary material industry. Bamo Technology, BTR Group and Bangpu Recycling are in the second tier of the industry. Beijing Dangsheng Technology Co., Ltd, Hunan Changyuan Lico Co., Ltd, Ningbo Shanshan Co., Ltd, Guizhou Zhenhua New Material Co., Ltd are in the third tier of the industry.

Future Development Trends

It is important to note, there is an ongoing shift in popularity from ternary cathode material to LFP cathode material, mainly due to the following reasons.

- Cost and energy density: LFP cathode material is relatively inexpensive compared to ternary cathode material. However, ternary cathode material have a higher energy density.

- Safety and temperature resistance: LFP cathode material offer advantages in high safety compared to the more flammable ternary cathode material.

- Raw material availability: ternary cathode material has a higher cash cost due to limitations in the availability of raw materials. Cobalt mining is complex and expensive, and the price of nickel fluctuates greatly at times.

- Market trends: The adoption rate of EVs equipped with LFP batteries sold in China has surpassed that of ternary batteries 2022. Major Players such as Tesla are using LFP batteries produced from CATL in vehicles made in China.

However, the global ternary cathode industry will present a prosperous “both price and volume” in 2023 and will continued growting. Furthermore, the growth of high-performance EVs will continue to drive demand for ternary batteries. Moreover, by 2024, China’s ternary cathode industry alone will exceed US$34.55 billion.

Contact us to purchase the full report today

Click to view the Table of Contents

What is driving the growth of the global ternary cathode material industry?

Momentum is gaining due to its high-performance from using cobalt and nickel, enabling an attractive option for manufacturers looking to produce superior high-energy battery products to low-energy density products.

How is the market segmented and which countries are leading its growth?

The main countries which produce ternary cathode material include China, Japan, and South Korea. Of which, these countries hold a combined market share of 85% worldwide. Other coming up countries include Germany. In China, the leading ternary cathode material manufacturers include Shanshan, Xiamen Tungsten, Ronbay Materials, Zhenhua New Materials, and Dangsheng Technology.

What are the key trends shaping the future the industry?

Both LFP and ternary cathode material are complementary technologies. They have different advantages and disadvantages that make these technologies more or less attractive depending on end-use requirements. For example, in EVs where achievable speed and the ability to drive longer distances are prioritised over price, with ternary cathode material more popular due to its higher performance.

Further reading

Our research reports include an introduction, industry chain, product specifications, processing methods, raw material requirements, cash cost analysis, pricing metrics, future industry development trends, and the competitive landscape. Reach out by email and contact us today to learn more.

You might be interested in our other battery mineral research reports

For Further Information