Introduction

Nickel sulfate hexahydrate is used to produce nickel-rich ternary cathode material, which is a main component material in the makeup of high-performance lithium-ion power batteries. Moreover, the nickel helps to improve the capacity and electrochemical performance of lithium-ion batteries, of which, the content of nickel sulfate hexahydrate is around 22.33%, and it is weighed and combined with other chemical salts to form the ternary cathode material.

Principal Processing Methods

The raw materials are mainly nickel pellets (refined nickel), MHP and high matte nickel, but China is not the main producing area for nickel pellets, MHP or high matte nickel. Specifically, the production of nickel pellets is concentrated in Australia, and the production of MHP and high matte nickel has been concentrated in Indonesia and other places in recent years. Notably, Indonesia accounts for 25.5% of global nickel intermediate production, Finland accounts for 16.1%, the Philippines accounts for 15.7%, and Australia accounts for 11.1%. In other words, although China dominates global production, its raw materials are highly dependent on overseas, forming a global nickel sulfate production model of “overseas resources + Chinese processing”.

Generally speaking, a hydrometallurgical process is used to produce battery-grade nickel sulfate hexahydrate, where nickel is extracted from ores, intermediate products such as MHP or recycled materials, followed by the crystallisation of nickel sulfate.

In summary, the process involves several steps, including the extraction of nickel sulfate from nickel ores, purification, and crystallization. The crystallization step is crucial for obtaining high-purity nickel sulfate hexahydrate, which is essential for battery applications.

Industry Challenges

The challenges in producing battery-grade nickel sulfate hexahydrate revolve around ensuring high purity, efficient crystallization, environmental sustainability, and addressing the supply and demand dynamics driven by the increasing use of nickel in lithium-ion batteries.

- High Purity Requirement: Battery-grade nickel sulfate hexahydrate needs to be of high purity, with specific nickel content and low levels of trace metal elements, to meet the stringent quality standards for battery applications.

- Efficient Crystallization: The crystallization process is crucial for producing high-purity nickel sulfate hexahydrate. Optimal crystal size and size distribution are essential to meet the high purity requirements for battery-grade nickel sulfate.

- Environmental Sustainability: There is a growing emphasis on environmentally sustainable production methods for nickel sulfate hexahydrate to meet the increasing demand driven by the battery revolution.

- Supply and Demand Dynamics: The capacity to produce nickel sulfate is expanding, but there are concerns about whether the supply will be sufficient to meet the rising demand for battery-grade nickel sulfate.

Commercialisation

Nickel sulfate is mainly used in the production of ternary lithium batteries. According to the classification of material systems, power batteries can be divided into two categories: lithium iron phosphate batteries and ternary lithium batteries. The difference in structure leads to differences in material properties, which determines their different application fields.

Lithium iron phosphate has low cost, high safety and long life. It is suitable for scenarios with high safety and life requirements, such as commercial vehicles and energy storage. In recent years, with the improvement of battery pack technology, its application proportion in the field of passenger cars has increased. Increasing year by year.

Most importantly, ternary cathode material has the advantage of high specific energy and are suitable for scenarios that require high energy density and high customer experience, such as the passenger car field. Of which, ternary lithium batteries require battery-grade nickel sulfate to prepare ternary precursors, which are important raw materials for manufacturing ternary batteries.

Rise of “High-Nickel”

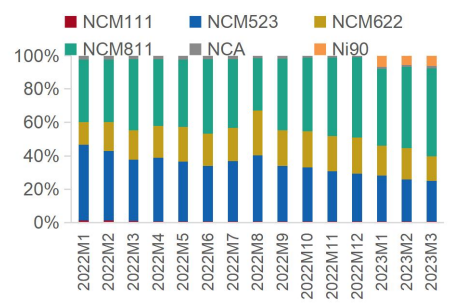

Nickel determines battery energy density, and the trend of high nickel is significant. Firstly, the level of nickel content determines the energy density of the battery material, that is to say, the higher the nickel content, the higher the energy density. Secondly, according to the nickel content, it can be divided into low nickel ternary (NCM333), medium nickel ternary (NCM523, NCM622), and high nickel ternary (NCM811, NCA).

Interestingly, range and safety are the most important factors for consumers when purchasing new energy vehicles. They determine the direction of technological changes in battery materials. Importantly, battery material upgrades will take three routes: economical, performance and high-end. Of which, the performance route is mainly medium-nickel high-voltage ternary or large monocrystalline ternary, which is mainly used in mid- to low-end new energy passenger cars. Lastly, the high-end route is mainly based on ternary high nickel/ultra-high nickel, which is mainly used in high-end new energy passenger cars with long endurance.

Competitive Landscape

Notably, as the proportion of high-nickel ternary cathode material products increases, the installed capacity of ternary batteries increases, and the amount of nickel sulfate used as ternary precursors increases accordingly.

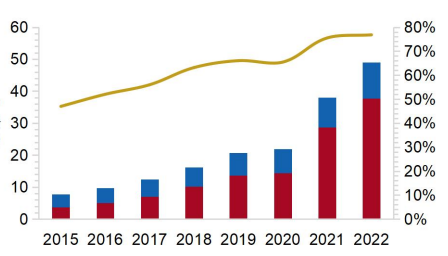

Moreover, In 2022, global battery-grade nickel sulfate consumption was 491,000 tonnes, a year-on-year increase of 43.2%, making for a high growth market in the nickel sector.

Firstly, China dominates global nickel sulfate production. In 2022, China’s nickel sulfate production will be 377,000 tonnes of nickel tonnes, accounting for 76.8% of the global total production. From 2015 to 2022, the proportion of China’s nickel sulfate production will gradually increase, from 47% in 2015 to 76.8%.

Most importantly, from the perspective of China’s market, the nickel sulfate market is highly concentrated, with the top 4 companies accounting for 48% and top 8 companies accounting for 65%. Moreover, there are currently more than 50 Chinese companies with nickel sulfate production capabilities. In addition to downstream cathode material manufacturers, there are also some resource recycling companies.

Lastly, only 5 companies have a production capacity of more than 20,000tpa including Hunan Zhongwei New Materials (72,000tpa), GEM (60,000tpa), Bangpu Cycle (36,000tpa), Jinchuan Group (24,200tpa), Ningbo Changjiang Energy (24,000tpa).

Contact us to purchase the full report today

Click to view the Table of Contents

Further reading

Our research reports include an introduction, industry chain, product specifications, processing methods, raw material requirements, cash cost analysis, pricing metrics, future industry development trends, and the competitive landscape. Reach out by email and contact us today to learn more.

You might be interested in our other battery mineral research reports

For Further Information