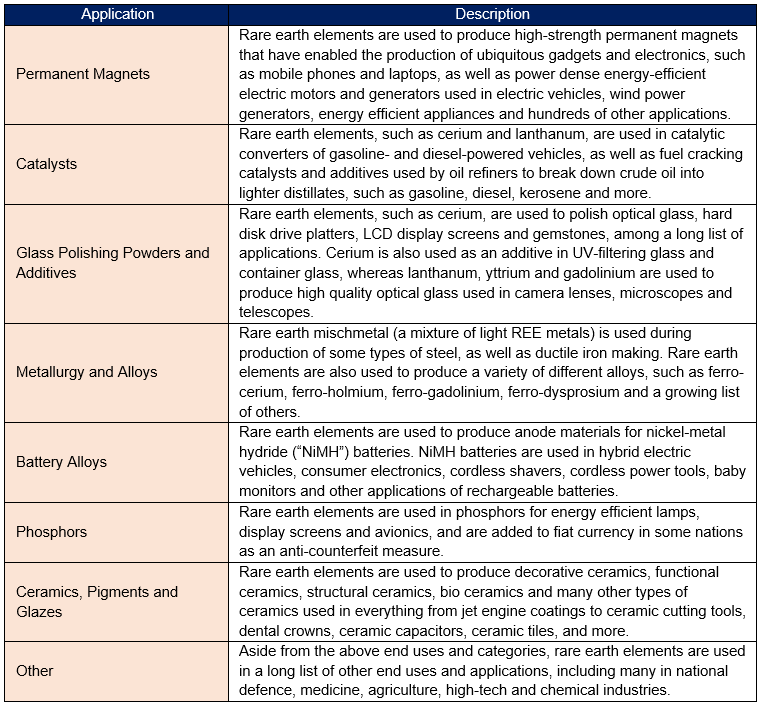

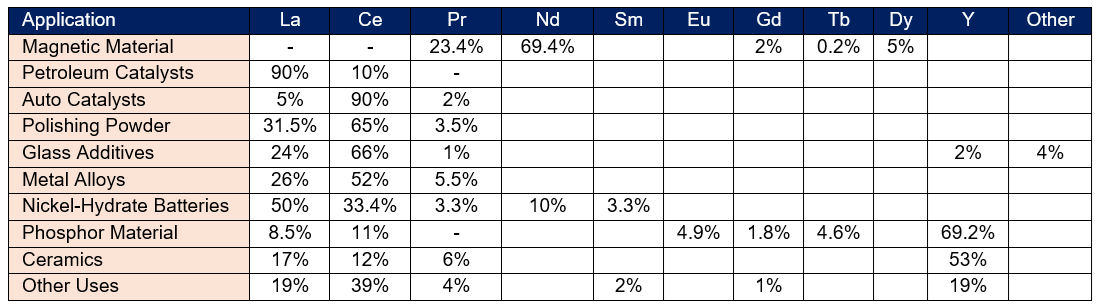

Rare earth functional materials have an irreplaceable position in many downstream sectors, especially in NdFeB magnets, petroleum and auto catalyst material, polishing material, as an additive in non-ferrous metal alloy materials, glass, ceramics, and optics.

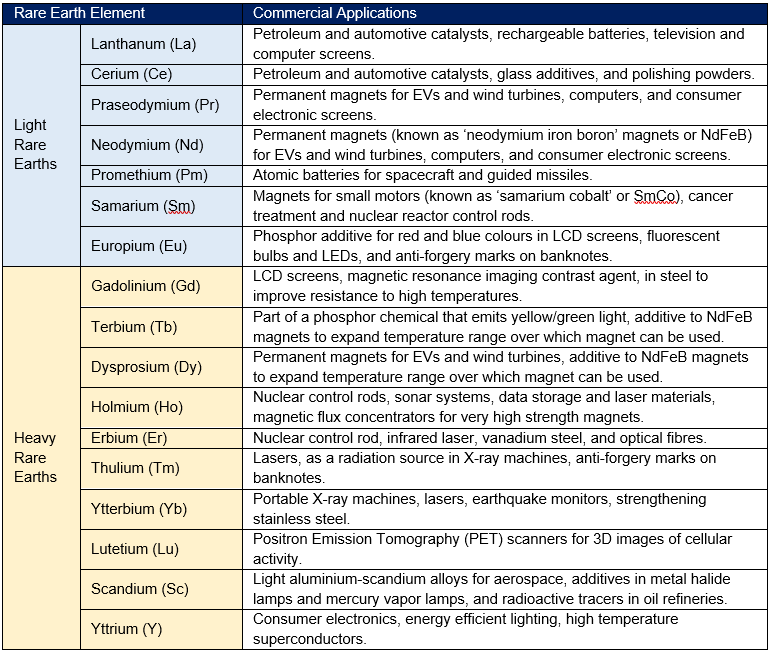

REE refers to a set of seventeen (17) chemical elements in the periodic table, namely the fifteen lanthanides, as well as scandium and yttrium. The 17 elements include cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y). They are often associated with thorium (Th), and less commonly uranium (U). REE are categorised by their atomic weight into light rare earth elements (LREE) and heavy rare earth elements (HREE).

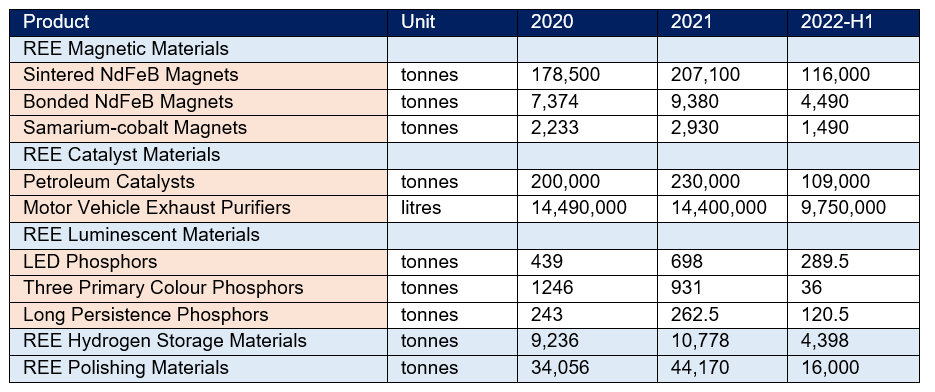

Rare Earth Functional Materials Market Forecast

In 2019, rare earth mine production was estimated to total 182,000 tonnes REO with refined production estimated to be 173,000 tonnes REO. China dominates the global supply of rare earths at both the mined and refined stages, accounting for 63% of global mine production and 85% of refined production in 2019. The USA and Australia are the second and third largest suppliers respectively, with production of 21.1kt REO (Mountain Pass) and 14.0kt REO (Mt Weld) in mineral concentrates during 2019.

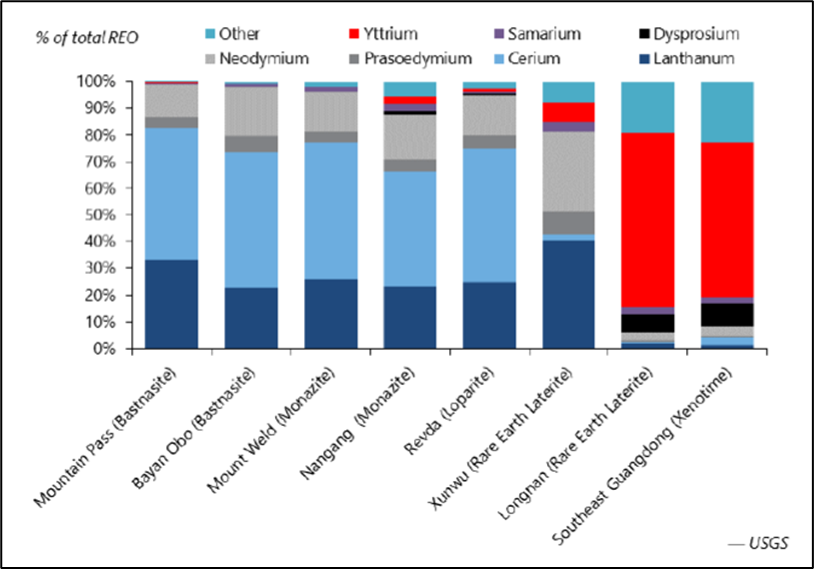

REEs are found combined in mineral deposits of bastnaesite, monazite, loparite, xenotime and ion adsorption clays. It is not possible to mine and separate one or two rare earths. Bastnasite, a carbonate-fluoride mineral, and loparite typically contains cerium, lanthanum, neodymium and praseodymium. Monazite, a phosphate mineral, typically contains cerium, lanthanum, neodymium and samarium. Xenotime is the main yttrium mineral and is high in dysprosium. The two main types of rare earth ion adsorption clays (laterites) in southern China are ‘Xunwu’ with low cerium and higher lanthanum, neodymium and praseodymium and ‘Longnan’ with very high yttrium and dysprosium.

Trends Affecting Rare Earth Element Supply and Demand

Rare earth elements therefore suffer from a supply and demand imbalance problem, as the ratio in which the elements occur in nature differ significantly from the ratio in which they are used in industrial applications. As a result, depending on the industrial sector, some rare earth elements will be in a significant oversupply whilst others are in supply deficit which can result in extreme pricing scenarios.

Over the past decade, rare earth producers globally have sacrificially overproduced certain low value rare earth elements, such as cerium, to keep up with rapidly growing demand for other high value rare earth elements, such as neodymium.

Higher-priced REEs can also affect supply and demand. The experience in the wake of the 2010 rare earth industry crisis is that substitution was widespread and alternative supplies were developed.

The scramble for supplies sent prices for the various rare earth elements up between three and nine-fold. The elements used for magnets jumped from around US$40 a kilogram to about US$500. Another rare earth, dysprosium, used for magnets that have to operate at high temperatures, leapt from US$170 a kilogram to US$1,600. Even cerium oxide, which is one of the most abundant of rare earths and used for polishing glass and as a phosphor in lighting and screens, rose more than threefold from US$30 to US$100 a kilogram.

Commercialisation

Demand for rare earths can swing dramatically with technological change. In the past new technologies introduced have replaced rare earth consuming technologies, in turn reducing the overall global rare earth oxide consumption.

In 2012-2013, LED technology took over from florescent lamps. As a consequence, the requirement for traditional phosphors, europium and yttrium, was reduced dramatically. A further transition is currently underway in the battery sector with NiMH batteries gradually being replaced by Li-Ion batteries.

Then in 2015 China scrapped its export quotas and export tariffs on rare earths after losing a World Trade Organisation case led by the USA and supported by Japan and the EU. In consequence, export prices declined by 20 to 35% over the following two months resulting in a six year low in pricing.

Looking forward, with the increasing technological shift from internal combustion engines to electric vehicle technologies together with the support of government policies and funding initiatives, it is forecast that demand for rare earths used in magnets will grow substantially over the medium term out to 2030, while markets for other rare earth elements are expected to be more balanced.

Contact us to purchase the full report today

Click to view the Table of Contents

Further reading

In addition, our research reports include an introduction, industry chain, product specifications, processing methods, raw material requirements, cash cost analysis, pricing metrics, of which, future industry development trends and the competitive landscape are important. Finally, reach out by email and contact us today to learn more.

You might be interested in our other battery mineral research reports

For Further Information